The White House is preparing to announce a student loan forgiveness relief plan as early as 24 August 200, according to people familiar with the plan. Details of the much-anticipated plan remain in flux amid last-minute intense internal debate over how policy should be structured, people said. Focused on saving $10,000 for borrowers under $125,000. This will permanently eliminate debt for millions of American students which were student finance.

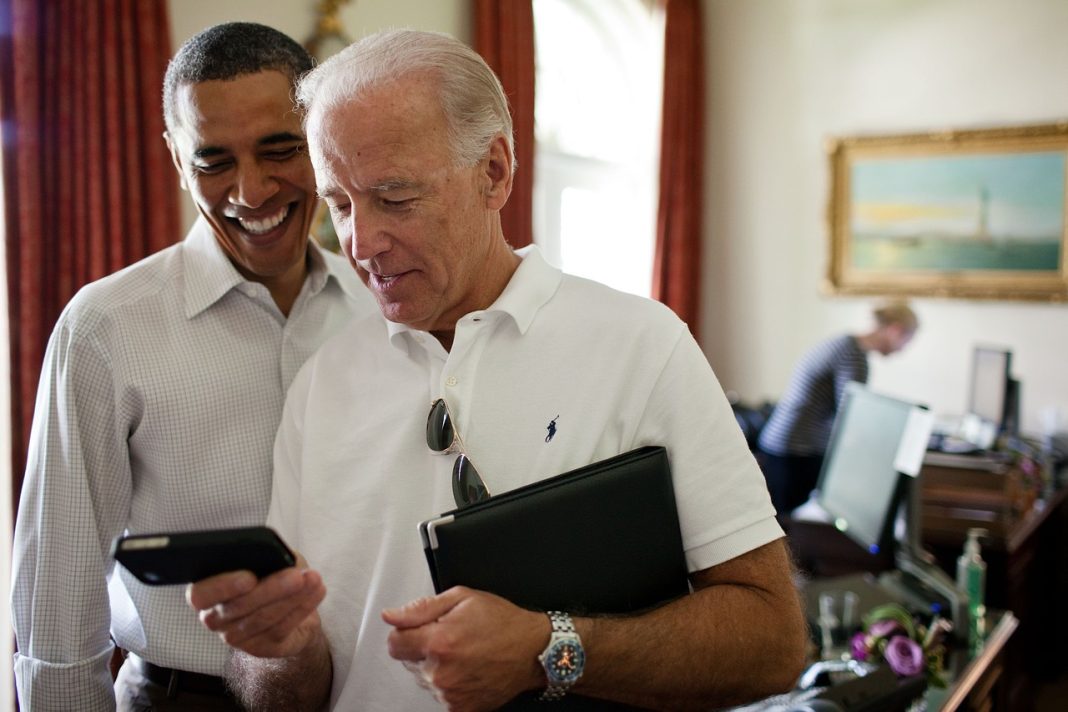

The tens of millions of Americans with federal student loans may eventually find out, if anything, soon what the Biden administration has decided to do about debt relief. “Since the president took office, this country hasn’t paid a single penny on federal student loans,” White House Press Secretary Jen Psakih said at a news conference Monday, referring to the suspension of interest on debt. .

The tens of millions of Americans with federal student loans may eventually find out, if anything, soon what the Biden administration has decided to do about debt relief. “Since the president took office, this country hasn’t paid a single penny on federal student loans,” White House Press Secretary Jen Psakih said at a news conference Monday, referring to the suspension of interest on debt. .

Many of the estimated 44 million federal debtors welcome the $10,000 forgiveness, but some progressives are seeking greater relief, including up to $50,000 per borrower. Penn believes this will cost him about $980 billion over ten years.

She went on to say that President Joe Biden “will make a decision on canceling student debt before this student loan suspension is complete.

Penn analysis shows $10,000 per borrower. Debt relief will also disproportionately help wealthy households: 69% to 73% of the debt forgiven belongs to households in the top 60% of the income distribution. However, at the reported income cap, the top 10% of households would receive less than 2.5% of the benefits.

Mr. Smetters said that compared to other means-tested programs, such as the Supplemental Nutrition Assistance Program (SNAP), which helps Americans who are by definition low-income, higher incomes are possible if federal student loans are allowed. is obtained.

“Who has student loans? These are the people who have a degree, so they can make more money.

Programs already exist to help low-income Americans get their federal loans forgiven, Smetters said. The battle is to get more people to sign up.

“A lot of people don’t know that income-based repayment plans already exist,” he says. “Some people have literally nothing to pay back.”

An earlier report by the Federal Reserve Bank of New York found that a $10,000 forgiveness could pay off about a third of borrowers’ debts in full. understood.

The Biden administration has been debating for months whether to forgive his $10,000 per borrower student loan.